5 Reasons Why You Shouldn’t Go Global – Tailor-Made Online Payments

There is a common belief among global e-commerce companies that in order to make money it’s enough to let them in through a global channel, meaning implementing universal and most popular payment options.

Since the business is global, its customers should expect global solutions, isn’t it right? Credit card payments limited to Visa and Master Card, currency downsized to USD only – most of the world uses these options, so it should be understood as the best option. Well, is it truly the best option? What about the rest of non-dollar and non-credit card world?

The same goes with online payment experience. You’ve implemented the option into your website in a blink of an eye, that’s how you wanted it, to start the business off instantly. But the vital thing is, how much time does it take for your customers to pay via your website? Is it also in a blink of an eye? Can you afford to have a client wondering how much more clicks he needs to make in order to finalize the payment?

As you see, global and easy for you doesn’t necessarily mean the best for your target customers. No one likes to be treated globally. People love to be noticed and taken into account, even when it comes to satisfying their online payment options needs.

Let’s get down to the nitty-gritty of the perfect payment solution. Why it’s worth to make your clients feel at home even in the global e-commerce business? Here’s a couple of reasons:

1. You can earn more

By accepting only one, most widely used currency, let it be USD, you limit the number of your customers to the ones using it. And what happens with those paying with EUR, PLN, CAD or HUF? There are several possible scenarios, each ends with them leaving. And you losing money. First, they can’t find preferred payment option and that’s enough for them, they abort the process. Second, they are willing to try offered payment option, however they feel lost after a few seconds, they decide to go for safe and familiar alternative… on another website. Third, they don’t want to waste their precious time for calculating the cost from USD into regional currency they usually use. They look for a company allowing them to pay in whatever currency they want. The worst thing is, they could have been YOUR customers. If only you wouldn’t underestimate the power of human payment habits.

2. You can cut down the costs

Accepting various currencies, even all 180 of them, doesn’t mean you will lose your money during denomination. Obviously, currency exchange can be tricky since the rates tend to be variable but it is possible to manage exchange costs in an effective way. You can accept money in client’s currency and book them in that currency. And when the exchange rate is profitable for you, you will convert it. All you need is a bit of patience and strategic thinking, which will be awarded with increasing customer number and trust they put in your business.

Also worth reading: When do you need bank accounts in different currencies to accept payments online?

3. You can minimize the transaction abandonment rate

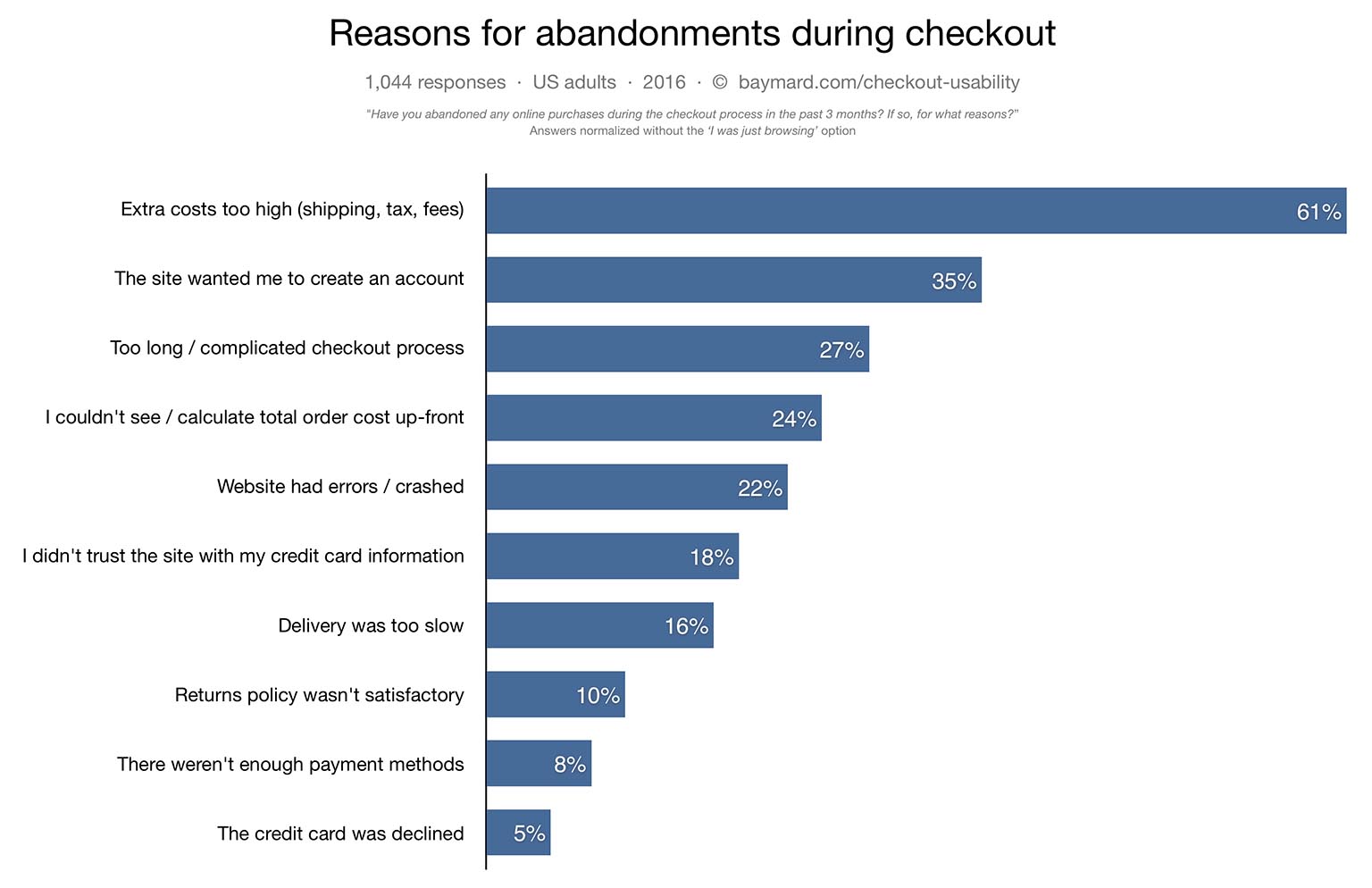

On average, 69.23% of Internet users abandon their carts before finalizing a transaction. In order to learn, how to lower that number, we must first understand, why people leave the website before the purchase.

In all fairness, some part of the abandonment is just a natural consequence of making the best choice while comparing a few similar e-commerce sites. These are unavoidable and we cannot influence them. But there are also reasons we have a large impact on. Have a look below:

Source: https://baymard.com/lists/cart-abandonment-rate

As you see, 27% of abandonments were caused by too long or complicated checkout process. A long, many-step payment process gives your possible customers the time to think, whether they really want your services. They can also get annoyed by more and more clicks and form filings. That’s when they decide to leave. Why don’t you improve the payment process? Make it short, intuitive, smooth, don’t give the customers time to hesitate. Let them buy with a single click, optimize your payment forms for a seamless buying experience.

4. You can offer more automated solutions

There are particular payment options that can be automated to a larger extent than others. It means you get to make it almost instant, easy and hassle-free for a customer. Take tiresome payment steps off his hands and do it by yourself, automate it. For instance, why don’t you charge customer’s credit card or his bank account? He doesn’t need to type in all the transaction details, he just clicks and the purchase is made. Facilitate the process as much as it is possible. Look for payment processors enabling high automation, they include, among others, PayPal or SEPA Direct Debit. The more you automate the process, the less abandonments occur. And it means one thing: potentially higher your e-commerce income.

Also worth reading: Which Online Payment Methods Allow Recurring Billings?

5. You can offer something different

Today being different from the competition is something giving you a head start in the business. There are hundreds of e-commerce offering the same or almost the same services and having an advantage over them, just like accepting more currencies or having a single-click online payment option, is a vital component of a success. If your payment method is innovative and unusual on the market, your PR image can benefit from it. People will see you as a company caring for its customers and considering their needs, making lots of effort to facilitate online payments for them. It also tells a lot about your business. Payment pages within your site can be tailored to reflect your company branding, look and feel.

All the factors mentioned above prove that going global also means going local. Even the biggest e-commerce business needs to listen to its customers voice when it comes to payment options. Of course, cards are and probably will be the most popular means of payment but if you’re aiming at conquering local markets, you need to allow for local payment habits. More often than not, habits are more powerful than global tendencies. Let’s take Poland into consideration: some Polish Internet users still prefer online wire transfers than credit card alternative. In Germany, Sofort or Giropay are quite popular.

If you plan to expand your e-commerce business, you must face the fact that customers’ needs are its major component.